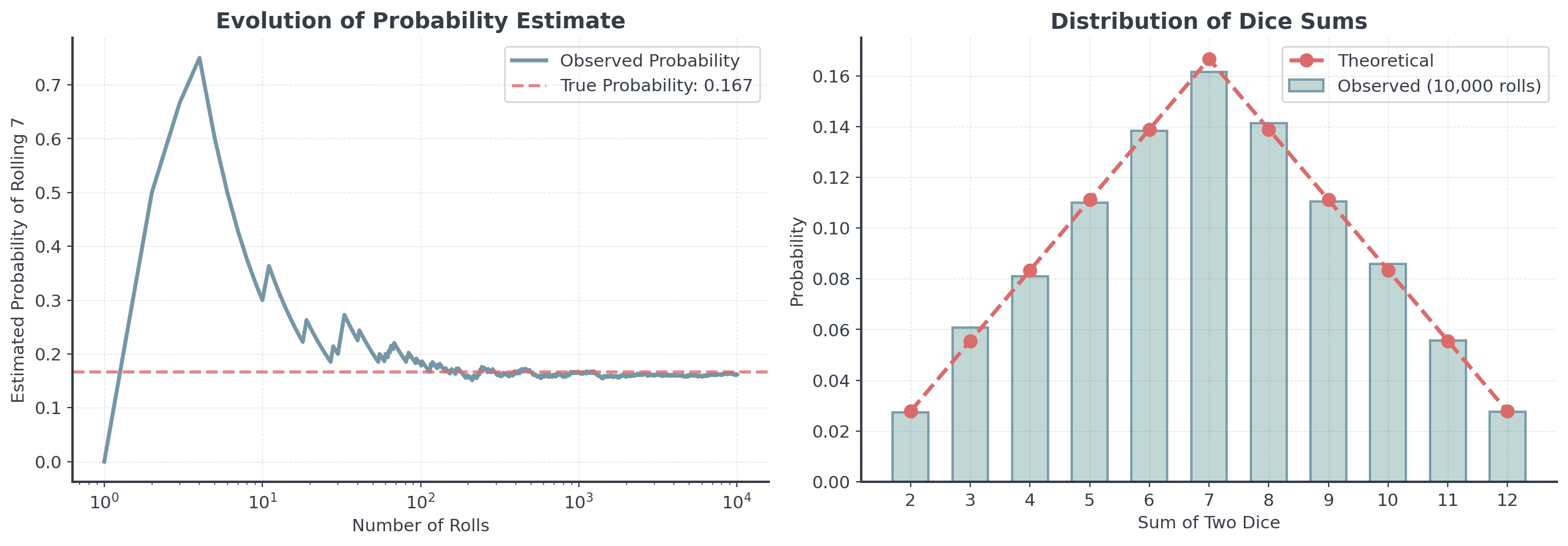

import numpy as np

np.random.seed(42)

# Roll two dice 10,000 times

dice1 = np.random.randint(1, 7, size=10_000)

dice2 = np.random.randint(1, 7, size=10_000)

total = dice1 + dice2

# What fraction equals 7?

probability = (total == 7).mean()

print(f"Simulated probability of rolling 7: {probability:.1%}")Simulated probability of rolling 7: 16.2%